RY 144.17 0.4529% TD 77.39 0.0517% SHOP 78.87 -1.3878% CNR 171.64 0.5625% ENB 50.09 -0.4769% CP 110.62 0.6277% BMO 128.85 -0.548% TRI 233.58 1.1563% CNQ 103.29 -0.174% BN 60.87 -0.2295% ATD 75.6 -1.447% CSU 3697.0 1.1582% BNS 65.76 -0.3485% CM 66.6 -0.5525% SU 54.21 1.1569% TRP 53.15 0.3398% NGT 58.54 -0.3405% WCN 226.5 0.4123% MFC 35.905 0.9986% BCE 46.75 -0.5954%

Company Overview: Square, Inc. (Square) is a commerce ecosystem. The Company enables its sellers start, run and grow their businesses. It combines software with hardware to enable sellers to turn mobile devices and computing devices into payments and point-of-sale solutions. Once a seller downloads the Square Point of Sale mobile application, they can take their first payment. With its offering, a seller can accept payments in person via magnetic stripe (a swipe), Europay, MasterCard, and Visa (EMV) (a dip), or Near Field Communication (NFC) (a tap); or online via Square Invoices, Square Virtual Terminal, or the seller's Website. Once on its system, sellers gain access to technology and features, such as reporting and analytics, next-day settlements, digital receipts, payment dispute management and chargeback protection, and Payment Card Industry (PCI) compliance. On the consumer (buyer) side, Square Cash offers individuals access to a way to send and receive money.

SQ Details

Square Inc (NYSE: SQ) is a provider of mobile payment solutions; and is into the development of point-of-sale software that supports in digital receipts, inventory, and sales reports. The company provides analytics, feedback, next-day settlement, and chargeback protection. The group is now well-known to provide creative solutions in the supportive financial payments space. The cloud based interfaces, other technological advances, updated software and hardware developments – all have started providing an edge to the company. This can be understood from its last quarterly result. Fundamentally, the margins are being worked upon towards an improvement while return on equity has significantly moved up from prior levels. Overall, the growth in the tech driven payment industry with many partnerships being eyed for, Square is expected to be in a sweet spot in the medium to long term.

SQ's latest launches (Source: Company Reports)

Launch of Square In-App Payments Software Development Kit: Lately, SQ has introduced Square In-App Payments Software Development Kit (SDK), to help developers and sellers on processing of payments through the mobile apps meant for consumers. Primarily, developers can build PCI compliant (secured and Square-powered) payments flow with the help of codes in a professional and seamless manner. This can be done in a mobile’s Android or iOS app. Thus, SDK enables many developers to manage the complexity associated with payments and the offering then manages the flow efficiently. As the in-App Payments via SDK have been made available for mobile’s iOS, Android, as well as Flutter, this has helped many customers and the other key aspect to note is the availability across the United States, UK, Australia, Canada, and Japan.

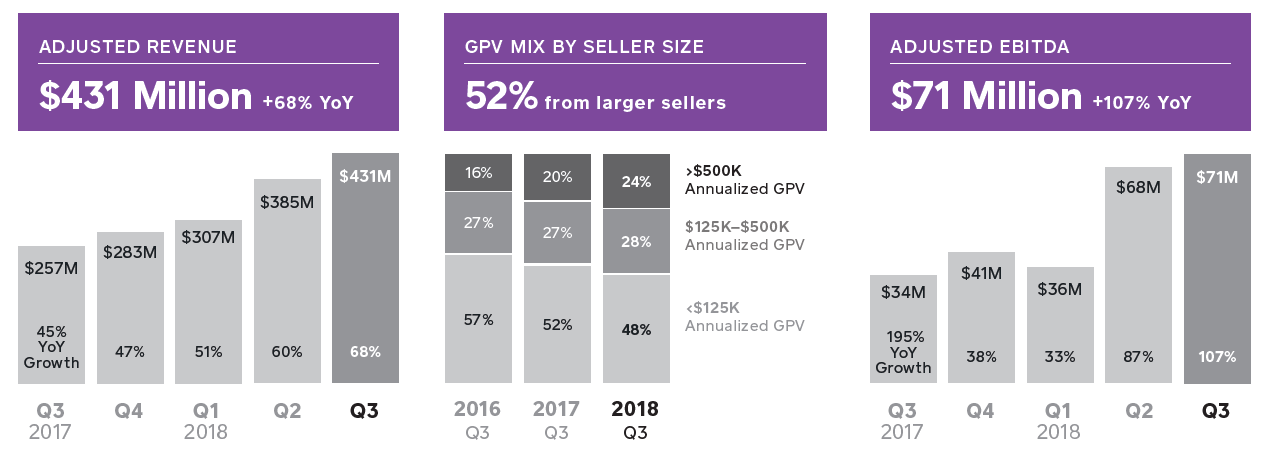

Financial Performance (Source: Company Reports)

Strong Performance in the Third Quarter 2018: For the third quarter of 2018, SQ has reported 29% growth in the Gross Payment Volume (GPV) to $22.5 billion. The company continued to drive volume from the large sellers as the GPV from the large sellers grew 41% year over year and forms for 52% of total GPV. This GPV is up from 48% reported in the third quarter of 2017. The company’s adjusted revenue grew 68% year over year to $431 million in the third quarter of 2018. Excluding the acquisitions of Weebly and Zesty, the total net revenue and Adjusted Revenue have risen 46% and 56% year over year. In the third quarter of 2018, transaction-based revenue rose 29% to $655 million. In the third quarter of 2018, transaction-based profit as a percentage of GPV increased to 1.07%, compared to 1.05% in the third quarter of 2017. The transaction-based profit grew on the back of benefit from increase in the transaction cost profile and due to increase in the higher-margin products. For example, Virtual Terminal, that provides the sellers to accept payments with the use of a web browser, has totaled GPV of more than $780 million in the third quarter, which is a rise of about 120% year over year. In the third quarter of 2018, the Subscription and services-based revenue grew 155% to $166 million year over year.

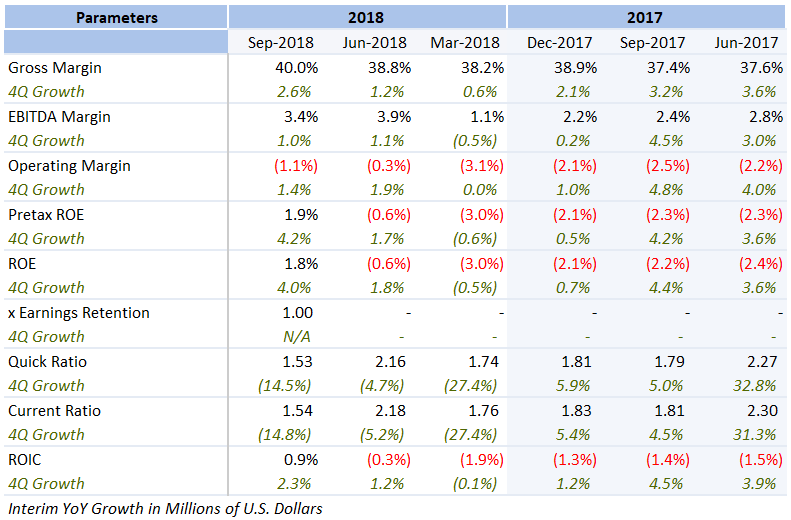

Ratio driven Performance (Source: Company Reports and Thomson Reuters)

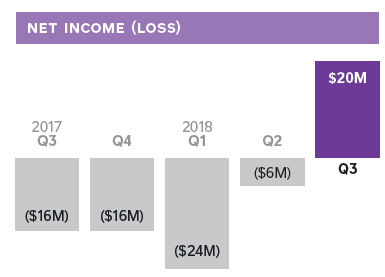

Growth from diverse segments and services while expenses need to be worked upon: Subscription and services-based revenue excluding the acquisitions of Weebly and Zesty rose 117% to $141 million year over year. The company achieved this growth majorly from Instant Deposit, Cash Card, Caviar, and Square Capital. Adjusted Revenue from subscription and services based revenue rose 165% to $172 million year over year. Square Capital also provided over 62,000 business loans to about $405 million in the quarter and this reflects a growth of 34% on a year over year basis. There has been a 72% growth in Hardware revenue to $18 million year over year, and this found support from continued growth in Square Register, Square Stand, Square Reader for contactless and chip, and third-party peripherals. Moreover, in the third quarter of 2018, Non-GAAP operating expenses increased by 56% year over year, which represents 67% of Adjusted Revenue. Overall, in the third quarter of 2018, the company reported the net income of $20 million, compared to a net loss of $16 million in the third quarter of 2017. SQ has included a gain of $37 million in the net income due to the IPO and subsequent mark-to-market valuation of the Eventbrite investment. The company has posted the net income per share of $0.05 and $0.04 on a basic and diluted basis, respectively, for the third quarter of 2018 (against net loss per share of $0.04 in the third quarter of 2017 on both a basic and diluted basis). The latest result is based on 410 million weighted-average basic shares and 475 million weighted-average diluted shares. Adjusting the effect of Eventbrite, in the third quarter of 2018, the basic and diluted net loss per share would have been $0.04. For the third quarter of 2018, the company has delivered the Adjusted EBITDA of $71 million compared to $34 million in the third quarter of 2017, which is an increase of 107% year over year. The company during the third quarter 2018 has achieved an Adjusted EBITDA margin of 16%, compared with 13% in the third quarter of 2017. The company has posted the adjusted Net Income Per Share (Adjusted EPS) of $0.13, which is based on 495 million weighted-average diluted shares for the third quarter of 2018, and reflects a $0.06 improvement year over year. Additionally, at the end of the third quarter of 2018, Square Inc, the company had $1.8 billion in cash, cash equivalents, restricted cash, and investments in marketable securities, which declined from $78 million compared to the end of the second quarter of 2018.

Net Income Scenario for the Third Quarter 2018 (Source: Company Reports)

Capital Management: In the third quarter of 2018, the holders of their 2022 senior convertible notes have converted an aggregate principal of $70 million. The company had during the quarter settled the principal amount in cash and for the balance the company has issued 2.2 million shares of the company’s Class A common stock. The company further expects to settle during the fourth quarter of 2018, an additional $149 million principal of the 2022 notes in cash. Later notes conversions will be settled entirely in shares of the company’s Class A common stock.

Appointment of Key Personnel & integration with Instagram and Google: SQ has appointed Amrita Ahuja as Chief Financial Officer, who has joined from January and will report to CEO Jack Dorsey. On the other hand, SQ has announced the integration of Square Appointments with Instagram and Google, through which the sellers will be allowed to grow awareness about their business and the company will be able to acquire new customers right from their social media feed or search results. According to SQ, over 50% of Square Appointments’ sellers do not have their own public website; and thus the free integration will assist the sellers to get discovered in an easy and affordable way. This will basically, allow customers to schedule their appointments directly from Google and through their Instagram page and no separate website will be required as a medium.

Outlook for the fourth quarter of 2018: SQ for the fourth quarter 2018 expects total net revenue to be in the range of $895M to $905M, Adjusted Revenue is expected to be in the range of $446M to $451M, year-over-year growth (midpoint) is expected to be of 59%, and Adjusted EBITDA is expected to be in the range of $75M to $80M. Net income (loss) per share is expected to be in the range of $(0.14) to $(0.13) and Adjusted earnings per share (diluted) is expected to be in the range of $0.12 to $0.13. This result is indicative of a decent performance.

Raised the Outlook for FY18: SQ has raised the outlook for FY 18. For FY 18, the company expects the total net revenue to be in the range of $3.26B to $3.27B from previous expected range of $3.19B to $3.22B, Adjusted Revenue is expected to be in the range of $1.569B to $1.574B from previous expected range of $1.52B to $1.54B, and Year-over-year growth (midpoint) is expected to be of 60% from previous expectation of 55%. Adjusted EBITDA is expected to be in the range of $250M to $255M from previous expected range of $240M to $250M, Net income (loss) per share is expected to be in the range of $(0.17) to $(0.16) from previous expected range of $(0.21) to $(0.17) and Adjusted earnings per share (diluted) is expected to be in the range of $0.45 to $0.46 from previous expected range of $0.42 to $0.46.

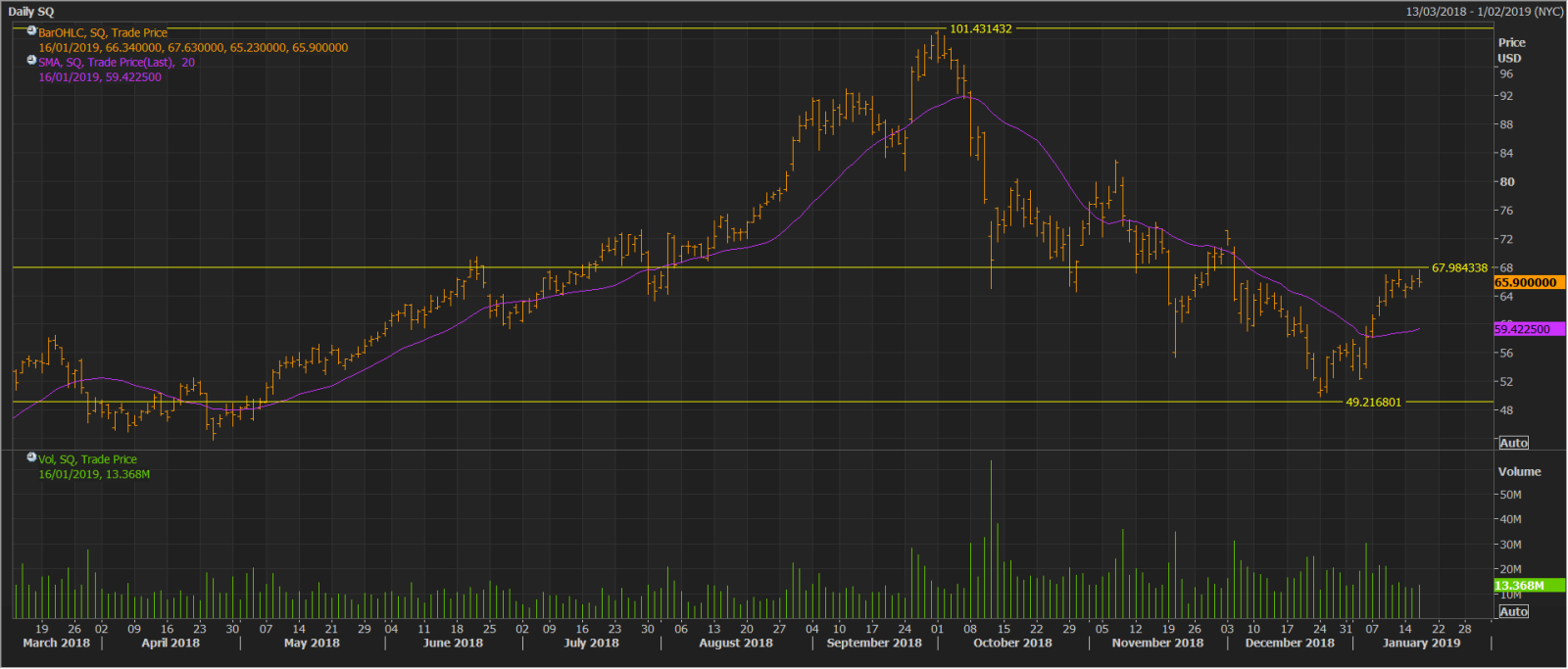

Stock Recommendation: SQ stock is trading at a price of $65.90, and has support at $50.6 level and resistance at $72. The company in the third quarter of 2018, reported for a turnaround to profit from loss and reflected very strong performance. As a result, the company had raised the full-year guidance of 2018 for total net revenue, Adjusted Revenue, and Adjusted EBITDA, which reflect the ongoing momentum of the company’s business. At a consensus EPS for forward 24 months in a positive zone, the stock might witness a double digit price upside. We give a “Buy” on the stock at the current price of $ 65.90.

SQ Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated websites are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.